Why Economic Opportunity is the Number One Resident Demand for Cannabis Legalization in NH

The first reason we might suggest is simply that supply is no longer an issue. Residents of New Hampshire now have three markets supplying their cannabis. These markets include the illicit market, the medical ATCs and the legal dispensaries on every border. This is why we continuously advise legislators that cannabis legalization is not a supply side request. Residents are not asking for legalization because they cannot find cannabis or to save a few minutes on the drive to a dispensary.

What you are asking for is economic opportunity. For legislators that may read this, here are a few examples of why economic opportunity is at the primary concern for residents of the Granite State.

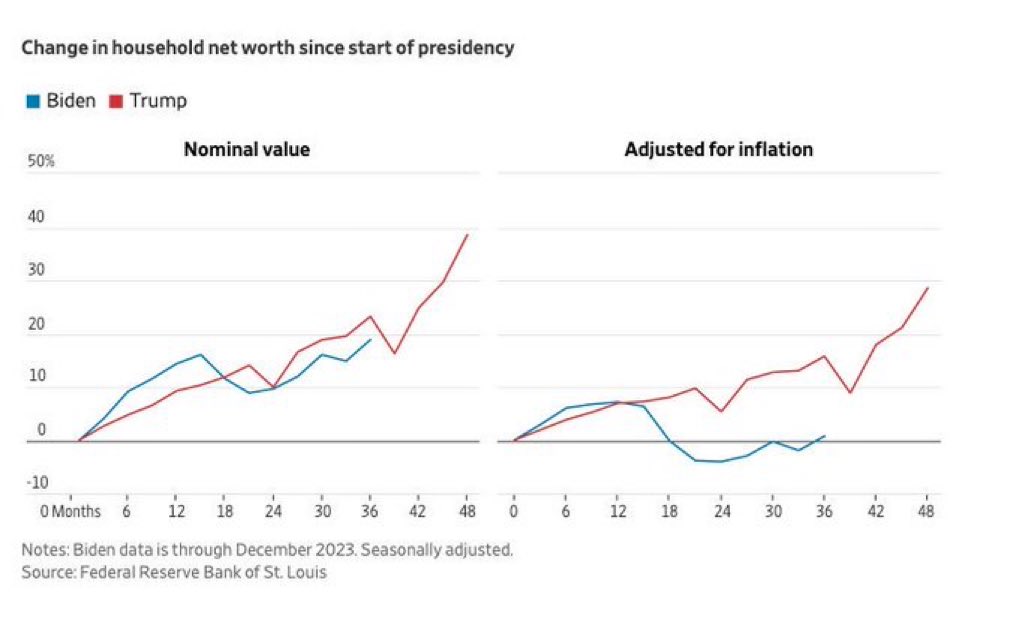

Everyone knows inflation has been out of control for years now. What few seem to realize is how that effects household net worth.

As we can see in this chart from the Federal Reserve, nominal net worth seems to track pretty consistently across the last two presidencies. But when you adjust for inflation…OUCH! Household net worth has actually been negative for quite some time and is just crawling into the positive.

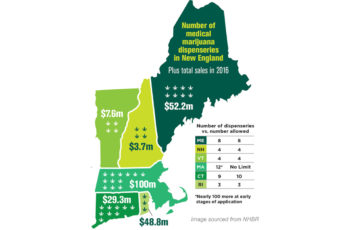

Ok fine, household net worth is down but at least NH home prices are beginning to drop right? Right?

July 9, 2024: NH Business Review reports Another Month, Another Record Increase in State’s Median Home Price. In January of 2020, a mere three and a half years ago, the median price of a home in NH was right around $300,000. Fast forward to June 2024 and the new median home price has increased to $538,000! If our math is correct, that is a whopping 79% increase!

Shoot. Maybe there is some hope coming in the form of the Federal Reserve dropping interest rates?

June 25th, 2024: Board of the Governors of the Federal Reserve System published Perspectives on U.S. Monetary Policy and Bank Capital Reform. Breitbart reports the following…

“The federal funds futures market implies a near certainty that the Fed will cut interest rates by the end of the year, pricing in a 94 percent chance of at least one cut and a 65 percent chance of two cuts by the December meeting. There’s still a 66 percent chance implied of a September rate cut, despite the political explosion a cut on the eve of the election would ignite.”

“On Tuesday, Fed Governor Michelle Bowman attempted to throw some cold water on the fervor for rate cuts. In prepared remarks delivered in London, Bowman said she sees a number of upside risks to inflation, reiterated the need to keep rates higher for some time, and noted that she would back more rate increases if inflation remains at the current level.”

“We are still not yet at the point where it is appropriate to lower the policy rate,” Bowman said. “I remain willing to raise the target range for the federal funds rate at a future meeting should progress on inflation stall or even reverse.”

June 27th, 2024: CNN reports The Housing Market is ‘Stuck’ Until at Least 2026, Bank of America Warns. According to CNN, “Help may not be on the way for first-time homebuyers frustrated by high mortgage rates and even higher home prices.”

“Economists at Bank of America warned this week that the US housing market is “stuck and we are not convinced it will become unstuck” until 2026 — or later.”

“The bank said home prices will stay high and go even higher. The housing shortage will persist. And mortgage rates may not fall much — even if the Federal Reserve finally delivers long-delayed interest rate cuts.”

“This will take many years to work itself out. There isn’t a magic fix,” Michael Gapen, head of US economics at Bank of America, told CNN in a phone interview. “The message for first-time homebuyers is one of patience and frustration.”

In short, those hoping for an interest rate cut this year might find that doesn’t happen but a rate increase remains a possibility. The downstream effects are that interest rates for home loans, car loans and all other types of loans remain high or go even higher furthering the economic strain on NH residents.

For those that might say hey, it’s just a little inflation. I’d recommend you view this video of businessman, investor and philanthropist Charlie Munger. Before he passed in 2023 he talked a lot about inflation and the course we are on as a country. )Video is embedded below.)

In the meantime, we cannot allow our legislators to legalize cannabis without maximum, widely distributed economic opportunity for the residents of this great state that are asking for the chance to throw your hat in the ring and compete. The chance to create a better economic future for yourself and your families. Continue to tell your legislators this is an absolute requirement.

Want to support our work? Consider making a donation or becoming a corporate member. Every contribution helps us to fight for cannabis reform in New Hampshire!

HELP SPREAD THE WORD!

Also, a reminder to visit our digital media properties at the links below. Like, follow, request access and share with like minded people in your network.

JOIN US ONLINE

- NHCann Manchester Networking Group: https://www.facebook.com/groups/2925591894124493

- NHCann North Country Networking Group: https://www.facebook.com/groups/2949979955281110

- NHCann Nashua Networking Group: https://www.facebook.com/groups/225983842586886

- Like our NHCann Facebook page: https://www.facebook.com/NHCannAssociation/

- Minds.com: https://www.minds.com/nhcannabisassociation/

- Instagram: https://www.instagram.com/nhcann/

- LinkedIn: https://www.linkedin.com/company/14044550

- Leafwire: https://www.leafwire.com/profile/company/5cc20da14d6ae9665d35cc40

- Twitter: https://twitter.com/NhcannO

Thank you to this article’s sponsor, Loanviser. If you need cannabis financing or cannabis credit card processing services, contact the experts at Loanviser today!